Welcome to the McDVOICE Survey online survey portal on the official website www.mcdvoice.com. The purpose of this survey is to ensure quality and standards that meet customer needs. In the McDVOICE survey, customers receive a discount coupon that they can redeem on their next visit to a McDonald’s store.

Our objective with this survey is to guarantee the quality and standards that correspond to the satisfaction of our clients. During the survey, customers receive a coupon code that they can easily redeem on their next visit to McDonald’s. The satisfaction of our clients is our priority to maintain our level of service. With this portal, we try to offer customers a real reward after completing the customer satisfaction survey.

McDonald’s is also interested in customer feedback and has launched the McDVOICE survey for this purpose. Almost everyone knows McDonald’s, but very few are aware of McDVOICE research.

The sole purpose of the McDVOICE survey is to obtain customer feedback and the quality of their food and service around the world. To maintain its standards and learn more about customer satisfaction, McDonald’s is conducting a survey at www.McDvoice.com. McDVOICE is bidding for foodies to enjoy food and it was suggested that they leave your valuable feedback. It’s just about making food better and tastier in the future.

Contents

- 1 Follow Given Survey Participation Steps

- 2 How To Generate Survey Code?

- 3 Survey Requirements To Be Fulfilled

- 4 Pattern Of Questions Of Survey Questionnaire

- 5 Check Out Survey Terms and Conditions

- 6 Take A Look At Survey Customer Benefits

- 7 Know Some Survey Key-Points

- 8 Earn Survey Rewards By Participating

- 9 Get Survey Contact Information

Follow Given Survey Participation Steps

McDVOICE has a number of specific requirements and steps that customers must follow. The McDVOICE survey has been a great help to McDonald’s in ensuring that customers enjoy their next visit to McDonald’s even more. McDVOICE is one of the most effective tools for McDonald’s to compete with competitors like KFC, Burger King, etc.

Have a look at the steps to be followed to be a participant of the McDVOICE Survey below:

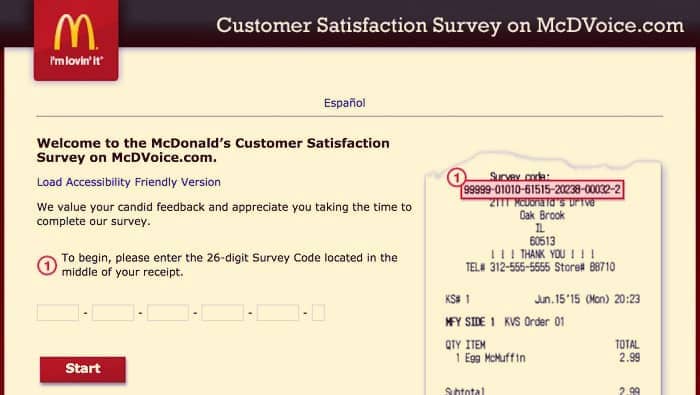

- It is recommended that you have your McDVOICE survey receipt handy when you complete the McDVOICE survey. This exam receipt contains a McDVOICE exam code that is stamped on the McDVOICE receipt.

- The McDonald’s Research Code contains a 26-digit receipt that you must submit after visiting the official McDonald’s website at www.mcdvoice.com.

- After entering the code number, you will be asked to provide the date and time of your visit, as well as your McDonald’s business number.

- After submitting the above details, tap Submit.

- If the above information is correct, you will be redirected to the McDVOICE survey home page.

- A McDVOICE questionnaire will appear on the screen, containing a series of questions from the McDVOICE survey.

- Answer all of these questions correctly.

- Once you have answered all of the McDVOICE survey questions, you will be asked to provide your contact details. Your information will be used to contact you if you become a McDVOICE survey winner.

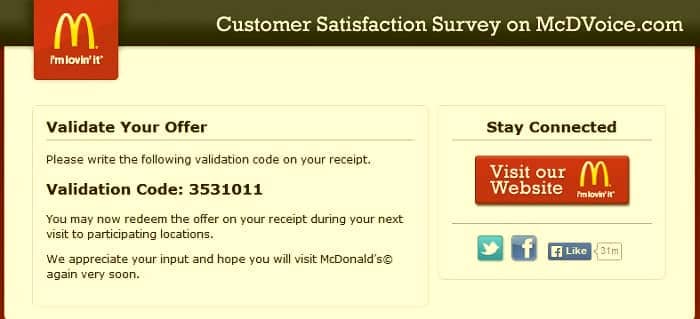

- You will now see a McDVOICE validation code, which means that you have successfully completed the McDVOICE survey.

Click on an image of the code or type it somewhere, as it will need to be validated the next time you visit McDonald’s. Only then will you be eligible for your free McDVOICE rewards.

How To Generate Survey Code?

To receive the rewards that McDVOICE offers, you will need a 26-digit survey code. This code can be generated by following the steps below:

- Visit the official site of this survey portal at www.mcdvoice.com using your browser of choice.

- Follow the instructions and enter the required data, Eg. The data requested are the name, date and time of the visit, agency number, etc.

- After submitting the correct information, click the “Start” button.

- Answer the survey questions and your verification code will be sent to you at the end of the survey.

From the beginning, McDonald’s wanted to present a unique and highly innovative way of engaging customers. However, great food and excellent service are always at the forefront.

This online customer satisfaction survey is an incredible effort by McDonald’s to listen to customer feedback and complaints and compensate them when necessary. McDonald’s is committed to customer satisfaction at its facilities and strives to increase customer love for McDonald’s.

Survey Requirements To Be Fulfilled

There are some basic McDVOICE survey requirements that must be met in order to participate in the McDVOICE survey. Look at these:

- You must be of legal age.

- Valid proof of purchase from McDonald’s is required.

- You must have the latest McDonald’s purchase receipt.

- You must complete a McDVOICE survey within 30 days of your visit to McDonald’s.

- If you don’t have a McDVOICE inquiry receipt, you can also use your order number.

- The winner’s bonus is not transferable under any circumstances.

After the McDonald’s survey, a validation code will appear on the screen. Make a note of this code as it will need to be confirmed the next time you visit McDonald’s to receive a free McDonald’s burger. Without this code, you do not have the possibility to enjoy free food.

1940 marks the creation of McDonald’s. You have just started the journey with a small supermarket chain and are now a globally recognized brand. McDonald’s has more than 35,000 points of sale around the world. The McDVOICE survey is popular with Americans because McDonald’s has done better than before.

If you are the winner of this customer satisfaction survey, you can also receive rebates or McDonald’s gift cards.

Another positive aspect of the McDVOICE survey is that it is available in two languages, namely English and Spanish. You can choose the language that suits you best. However, please note that the McDVOICE validation code will only be issued after the successful completion of this McDonald’s survey.

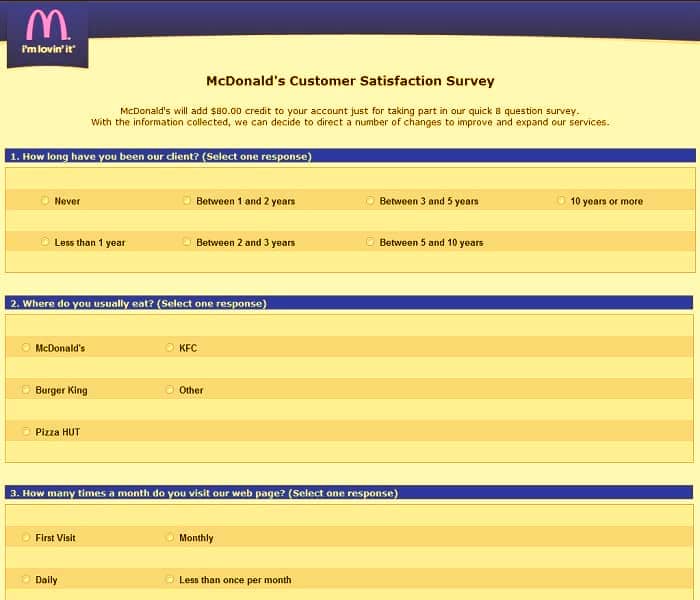

Pattern Of Questions Of Survey Questionnaire

You may be wondering what questions are included in this survey questionnaire. Is there a way to classify my issues? Is there a claim area? Scroll down to get the answers.

- You will first be asked about the last store you visited.

- You will also be asked to answer some questions about the taste of the food received.

- You will then be asked to rate the behavior of McDonald’s employees.

- You will also be asked to evaluate McDonald’s environment and hygiene.

- A separate text box is provided to explain your problem in detail.

- You will also be asked how often you visit McDonald’s.

Therefore, the McDVOICE survey is clearly made up of easy-to-answer questions. Because most of the questions refer exclusively to your last visit to the company. The McDVOICE survey at www.mcdvoice.com serves as a tool for both the business and the customer.

Check Out Survey Terms and Conditions

The McDVOICE customer satisfaction survey is subject to certain conditions that must be met. Check it out below:

- Anyone under the age of 18 may or may not participate in the McDVOICE survey.

- If you complete the McDVOICE survey, you will need to provide McDonald’s most recent proof of purchase.

- You must have a computer or mobile phone with a stable and active Internet connection.

- To participate in the McDVOICE survey, you must shop at McDonald’s.

- You must validate the McDVOICE survey code within 30 days of your visit to McDonald’s.

- Each participant can only participate once in this survey.

- Research grants are not transferable or negotiable in any way.

- In no case will the validation code of the survey be accepted 30 days after having responded to this customer satisfaction survey.

McDonald’s has provided excellent service for decades. The McDVOICE survey is popular with people in the United States and Canada. McDonald’s just wants to be the best in the world. The McDVOICE survey is one of the most important and effective tools to be the best. The McDVOICE survey is an incredible effort by McDonald’s, so your honesty is one of the most important things to McDonald’s.

Any response to the survey questionnaire will have a serious impact on McDonald’s services. After successfully completing the McDVOICE survey, you will be able to enter the contest and receive free rewards in the form of meals and rebates.

Take A Look At Survey Customer Benefits

What are the benefits to you as a McDVOICE survey customer? Well, as a customer, the main benefit of this survey is improving customer satisfaction at McDonald’s. Plus, the rewards this survey offers are a bonus. These delicious McDonald’s meals at a reduced price!

This survey portal can serve as a platform for you to post your comments and opinions about the services you received during your last visit to McDonald’s.

Taking this survey simply means giving you the opportunity to make your future visits to McDonald’s even more enjoyable.

Please note that the McDVOICE validation code is only valid for up to 30 days after completing the McDVOICE survey. Under no circumstances will you be able to validate your McDVOICE survey code after 1 month of participation.

By participating in the McDVOICE survey, you are making a significant contribution to improving McDonald’s customer service and menus. You will also receive a survey coupon code that can be used at any McDonald’s restaurant.

| Official Name | McDVOICE |

|---|---|

| Language | English & Spanish |

| Purpose | Survey |

| Rewards | Free Meals |

| Country | USA |

Know Some Survey Key-Points

- Any fraudulent activity related to the investigation, such as wrong answers, abuse, etc., will be severely penalized.

- Please note that searching on mcdvoice.com is only accessible to persons 18 years of age and older.

- The survey code can only be used once. Any attempt to use it more than once will be considered invalid.

- The survey code should only be used at McDonald’s. Third-party intervention is not expected.

You can complete the mcdvoice.com survey on the official website www.mcdvoice.com. You have a unique opportunity to earn lucrative rewards by completing the McDonald’s survey.

McDVOICE Survey plays an important role as it serves as a communication platform for restaurant staff and customers. Feel free to leave negative feedback on this online survey if you encountered any issues during your last visit to McDonald’s.

Earn Survey Rewards By Participating

McDonald’s management team values the time you invest and values your contribution. For this reason, they offer rewards for completing this survey.

By completing the McDVOICE survey in its entirety, you will earn rewards. Most of the time, you get discounts on your purchases at McDonald’s. However, the rewards for this survey change regularly.

The rewards also depend on your location, how long you’ve completed the survey, and what McDonald’s has to offer.

Get Survey Contact Information

If you have a problem with McDonald’s services or your McDonald’s request, you can contact McDonald’s customer service without further questions. Below you will find the contact details for this customer satisfaction survey:

- McDonald’s Headquarters: 2111 McDonald’s Dr., Oak Brook, IL 60523

- McDonald’s Customer Service Number: 1-800-244-6227 (7 AM to 7 PM)

- McDonald’s email address: [email protected]

- McDonald’s Official Website: www.mcdvoice.com

So it’s clear that you can complete this survey in seconds. Any comments in this survey will have a profound impact on McDonald’s services. Therefore, it is necessary that you answer honestly to each answer to this questionnaire.

Also, you cannot claim survey rewards until you redeem your survey code at McDonald’s in the United States.

The McDVOICE survey is easy to take, safe to complete, and worth it. If you are a McDonald’s customer, your participation is extremely valuable to McDonald’s. The McDVOICE survey only takes a few minutes, and in return, it promises things that will improve your time at McDonald’s.

The flexibility offered by this survey clearly explains the ideas McDonald’s invested in designing this portal. He made sure that someone from all walks of life and with little or no technical knowledge could answer the survey.

It is important that you write or take a screenshot/print of the redeemable code that you will receive after completing this survey. You can only receive your rewards after redeeming this code at any of the McDonald’s stores.

That’s all! Perhaps you understand the importance and the research process of McDVOICE. If not and you are unable to complete the survey, just use the comment section below and share your questions. We will contact you shortly with a suitable solution.